Are there more liberal or conservative customers in the United States? Are all customers liberal or conservative? What about moderates, independents, and centrists?

The United States is almost evenly split between conservative and liberal customers with varying degrees of conservative or liberal worldviews. I say “almost evenly split” because there is evidence that liberal customers slightly outnumber conservative customers. But that difference will likely disappear over the next ten to fifteen years for reasons explored below.

Each of the two markets has about 130 million adult customers. If each group were a country, it would be the tenth largest in the world.

No matter how you look at it, both markets are very big, and together they are huge. But, unfortunately, sizing and describing these markets gets confusing because worldview - conservative and liberal - gets tangled with politics, which invokes the ideas of being Republican, Democrat, Independent, Moderate, Centrist, and more.

For example, Gallup's research often distinguishes between Conservative, Liberal, and Moderate. In this case, people who lean conservative or lean liberal are grouped into Moderate. Is there a large group of Moderates? Yes, but Moderates don’t flip between liberal and conservative - they’re just moderate as conservatives or liberals.

It’s a similar situation when a state or county is deemed “purple.” The individuals don’t have mixed worldviews, but the state or county does. There is no purple worldview or ideology.

Then there are the “Independents.” Samara Klar and Yanna Krupnikov, political science professors at the University of Arizona and Stony Brook University, explore this group in detail in their book Independent Politics. They found that Independents declare this affiliation to avoid association with any political party. They explain that Independents are generally too embarrassed to admit being associated with either party, so they avoid it.

That embarrassment doesn’t mean Independents are actually independent. According to Pew Research, 81% of Independents lean toward one political party or the other. Within that 81%, there is an even split between conservatives and liberals.

So how do we get to a measure of the two customer groups in total?

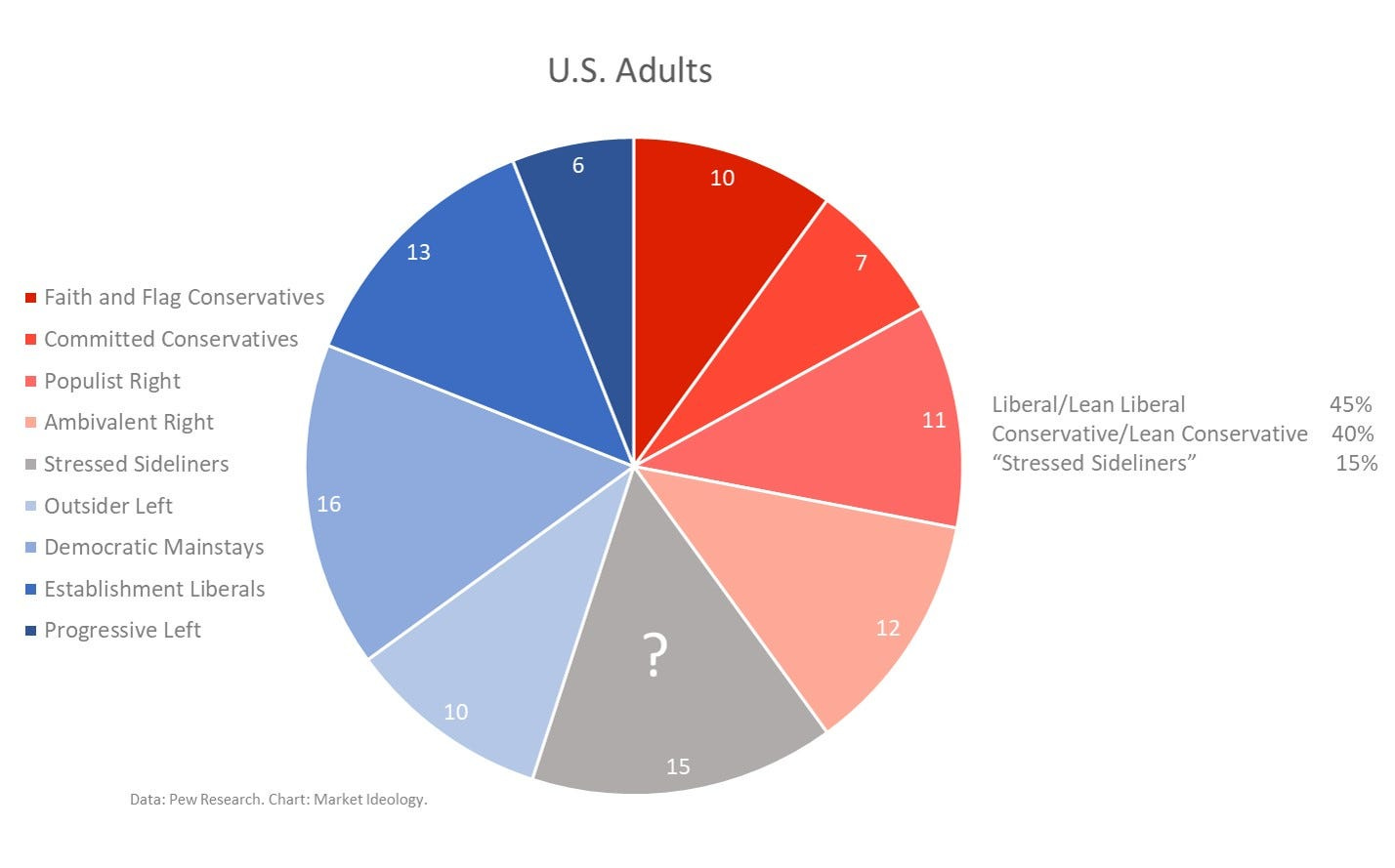

In November 2021, Pew published a “political typology” that breaks down liberal and conservative groups. This typology is interesting for business because it focuses primarily on worldview, not politics. As a second step, Pew applies the typology to political leanings. It’s the most helpful study I’ve seen for sizing conservative and liberal customer markets.

Here is a view of the Pew Research political typology:

Note that there are nine different groups. Four are liberal or lean liberal, and four are conservative or lean conservative. The liberal groups make up 45% of the adult population, while the conservative groups make up 40%. Then there is the “Stressed Sideliners” group, accounting for the remaining 15%. Pew separates this group because they have a lower propensity to vote. So we have to look at this group more closely to get an accurate division of liberal and conservative customers.

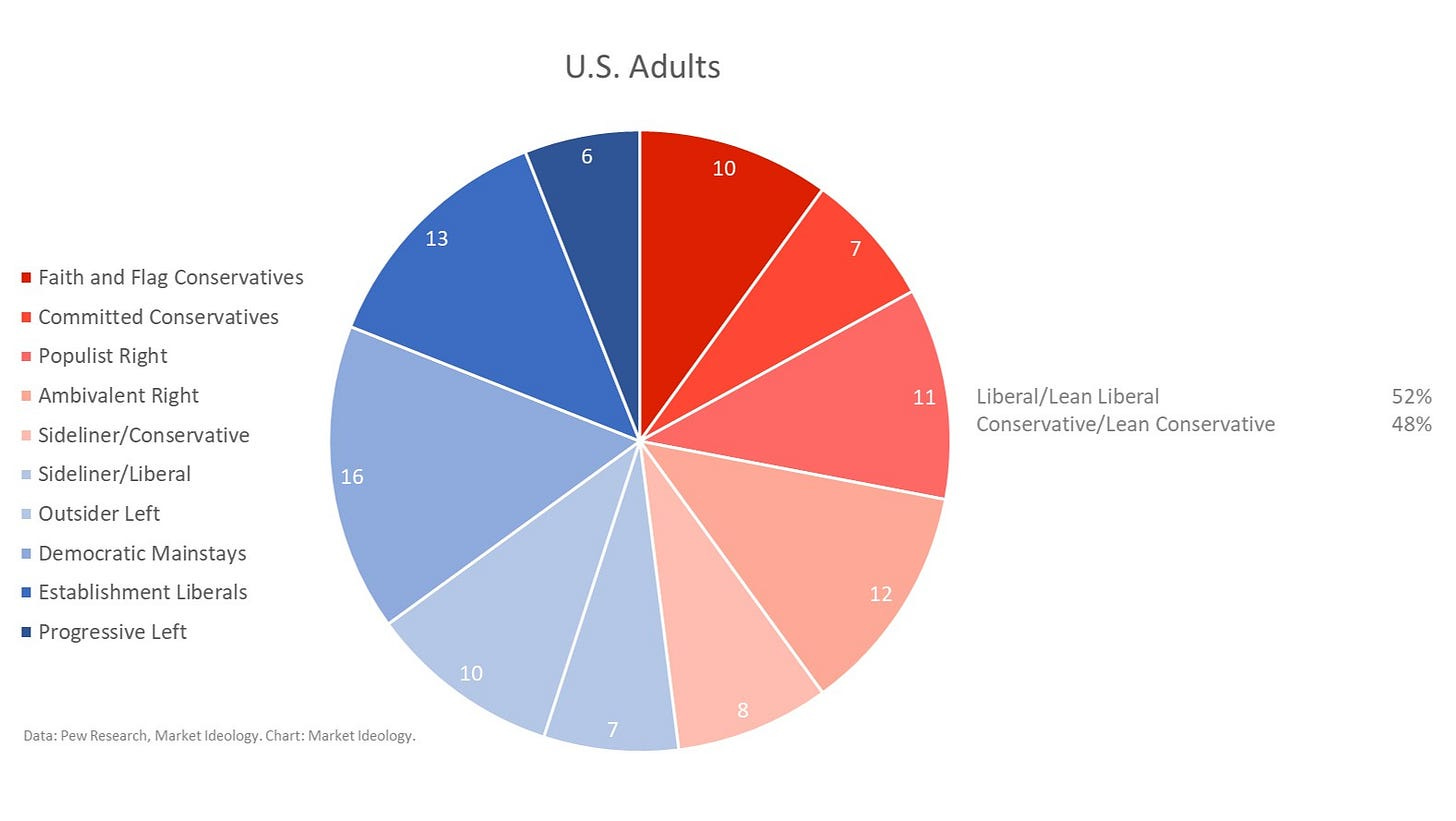

Pew describes the Stressed Sideliners group as mostly split down the middle with regard to political leanings and views on most issues. Here are two charts that demonstrate this using the Pew data:

As you can see, almost half voted for Biden, and a hair more than half voted for Trump in 2020. In terms of political party affiliation, this group is split in half, with just ten percent indicating no political party leanings. According to Pew, this group leans a little liberal on economic issues while leaning a little conservative on social issues. These are political distinctions, but we can use them to help translate the Stressed Sideliners into liberal and conservative segments.

Here’s an updated typology chart that includes dividing the Stressed Sideliner group:

With the Stressed Sideliner group allocated, we net out with 52% of the adult population as liberal or leaning liberal and 48% of the adult population as conservative or leaning conservative. When splitting the Stressed Sideliners, we gave seven points to the liberal and eight to the conservative sides. That’s a result of knowing that more conservatives identify as Democrats (12%) than liberals identify as Republicans (4%), together with the detail about Stressed Sideliners.

No matter how you split the Stressed Sideliner group, you end up with an almost evenly divided country. The small difference may be significant in elections, but not when sizing two very large markets for selling products and services.

There is also evidence that the two groups will become more evenly split over the coming ten to fifteen years.

Younger customers are more liberal, which can lead you to believe that as they age, the total number of liberal customers will increase over time. This idea fails to account for two forces that shape the worldview makeup: worldview propensity with age and age group waves.

As Americans age, they have a propensity to become more conservative. Sam Peltzman, professor emeritus in economics at the University of Chicago Booth School of Business, studied this phenomenon using data from the General Social Survey (GSS). The GSS spans fifty years and is run by the non-partisan research organization NORC at the University of Chicago.

Using this data, Peltzman developed worldview profiles of different age groups throughout those fifty years. He discovered that worldview profiles hold mostly steady no matter what period you are evaluating. Here is a view of his data:

The result is that age groups maintain their makeup in worldview whether you look at them now or thirty years ago. Younger, more liberal American customers become more conservative as they age. Peltzman comments, “All the chatterers on TV are fixated on this idea that young people have gotten more liberal, that they’re all socialists now. That’s wrong. They’re about as liberal, on average, as they have been over the past 50 years.”

In a previous article, I developed a model for thinking about liberal and conservative customers based on research in social anthropology. In that model, liberal customers show more egalitarian traits, and conservative customers show more positional or hierarchical traits. These distinctions may help explain the shift in worldview as customers age.

As younger customers move through life stages, they participate less in egalitarian environments and more in hierarchical environments. They shift from spending a lot of time in school and with friends and more time establishing a family, participating in the workforce, and managing their lives. Of course, not all younger, more liberal customers become conservative, but perhaps these effects of life stage contribute to shaping a customer’s worldview.

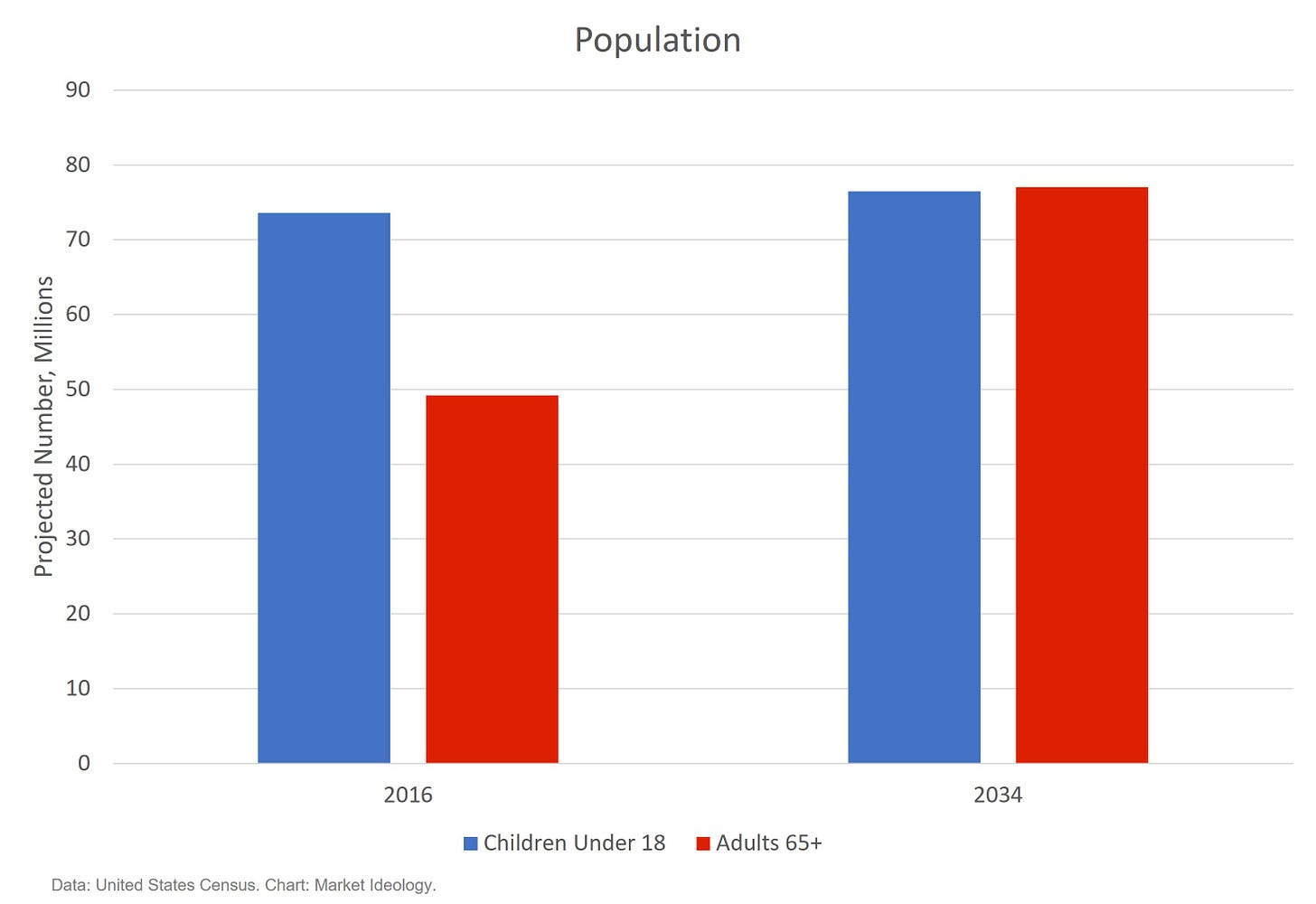

The second force shaping the worldview makeup of American customers is an age group wave. According to the U.S. Census, the American population is becoming older over the next couple of decades. Here is a chart showing the projected change from 2016 to 2034 for children and older adults.

While the population of children under eighteen increases by some three million from 2016 to 2034, the population of those who are sixty-five and over increases by twenty-eight million. That increase in the older population looks large, but not everyone in that group is conservative. In the end, over the next ten to fifteen years, the liberal and conservative groups will most likely even out or tilt very slightly toward conservative customers.

Age waves create minor fluctuations in population worldviews and are driven by population growth rates. According to World Population Review, the population of the United States continues to grow, but the rate is slowing. This deceleration contributes to having a population that will skew older for periods of time. That growth rate can change, creating a new shift in the population.

All of this informs market sizing for the two groups when considering who your market is and whether there is more of one than the other. Of course, your business will have its own market makeup of conservative and liberal customers, and your customer database may or may not reflect that split. See this article for example analysis of one company leaning into a liberal market and another leaning into a conservative market.

The starting point for the entire addressable U.S. adult population is a market fairly split down the middle for worldview, conservative and liberal. Each of the two markets has varying degrees of conservativism and liberalism, which calibrate the strength of their respective attributes. Up close, there are more liberal customers by a few percentage points. From twenty feet, for business purposes, they are equal in size and get more equal over time.